Swiss-based Swisscanto Invest and Danish investors ATP and BankInvest are the main investors injecting nearly $30 million into MedTrace, a company specialized in diagnosis of heart diseases. The fresh capital is a significant step forward in the company’s plan to expand into the USA as well as the establishment of a new business area within cancer diagnostics.

Introduction

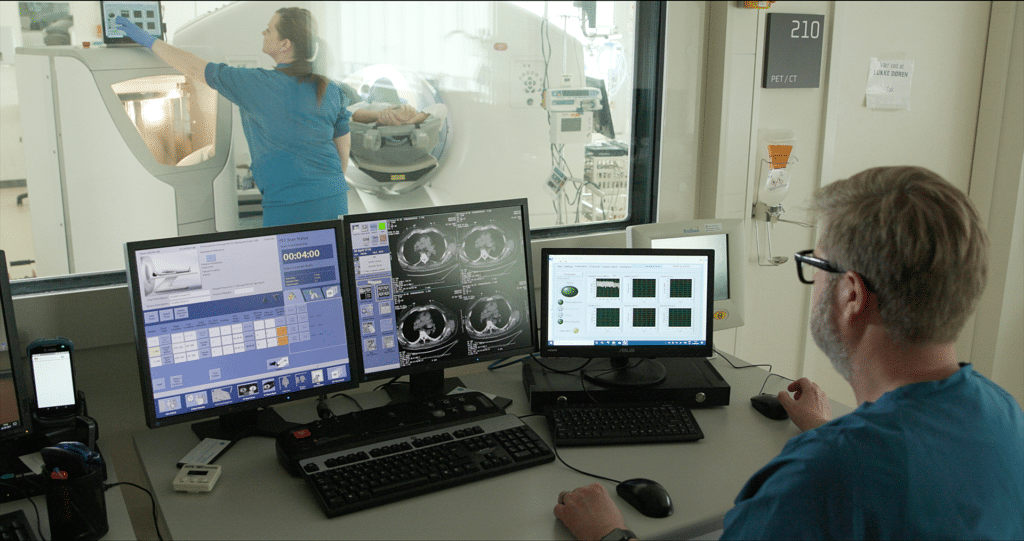

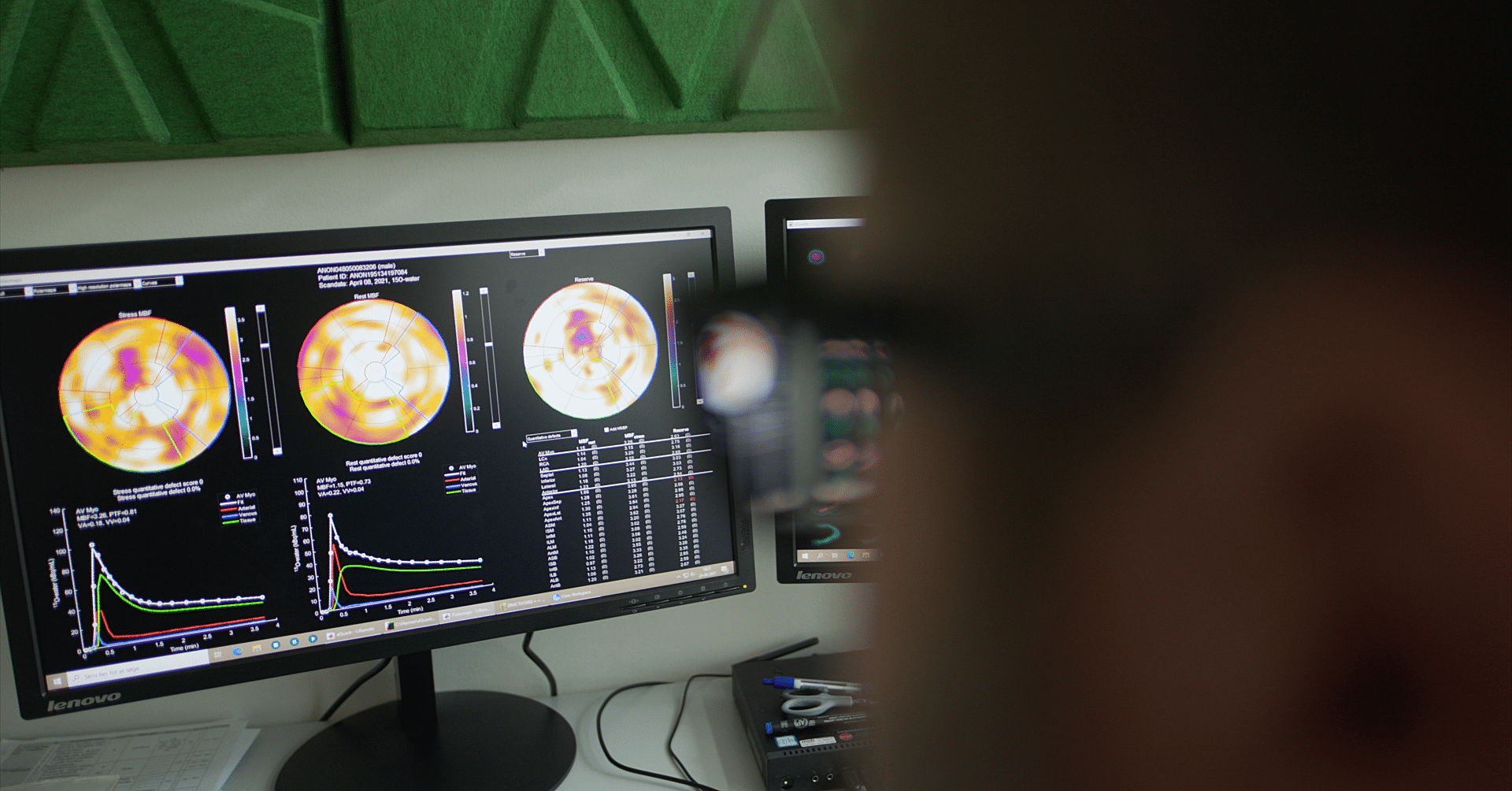

Danish company MedTrace has developed a fully automated technology that makes radioactive water clinically available to patients in need of diagnostic heart imaging. Radioactive water (15O-water), currently used on occasion for various types of scans, will now be produced inside the scanning room itself. This will allow hospitals to scan more patients with radioactive water in a shorter amount of time. Additionally, the cardiac scan results will be approximately 50% more accurate than conventional SPECT scans. The niche technology represents an estimated global market potential of DKK 6 billion for heart patients alone.

With investors such as Swisscanto Invest, ATP, and BankInvest onboard, MedTrace can now accelerate its European and American expansion plans. The investment equivalent of nearly $30 million will, among other things, pave the way for clinical studies in the USA and move the company closer to an initial public offering.

“I am absolutely delighted and proud to have got such a strong combination of investors into MedTrace. The investment is an official stamp for our technology and business model while also guaranteeing that we can now expand. We can start our clinical studies in the USA and begin scaling up our European business,” says Martin Stenfeldt, CEO of MedTrace.

Strong case with great growth potential

To date, the company has focused primarily on cardiology – diagnosing heart conditions – but the technology and knowhow from MedTrace can potentially improve diagnostics and treatment for cancer patients. The combination of a strong position in cardiology and a promising potential in cancer diagnostics prompted Swisscanto Invest to step up as a lead investor.

“MedTrace has considerable commercial potential with its technology and products boosting innovation of the medical tracer 15O-water and lifting up the quality of heart disease diagnostics to a new level. With its first products in cardiology already in clinical use the application in oncology seems to be a natural next step with an enormous market potential. We are pleased to be investing in this future development as part of a consortium of strong investors with shared ambitions and aspirations for the company,” announces Dr Robert Schier, Investment Director at Swisscanto Invest.

Danish-based ATP sees the investment as an opportunity to create a high return while generating growth and jobs in Denmark.

“We are looking for investment opportunities in all links of the financial food chain here in Denmark and see MedTrace as a high-tech Danish company with great growth potential both geographically and on the product side. We hope, long term, to be able to pave the way for an IPO for MedTrace in Denmark,” explains Claus Berner Møller, Vice President, Danish equities at ATP.

Danish investor BankInvest also has high expectations for the future development of MedTrace.

“With its technologies and products, MedTrace has managed to make 15O-water much more accessible as a tracer in scans. This provides a significant boost in both the quality and economy of heart disease scans to the great benefit of patients and the healthcare system. The next step is to spread the technology to cancer scans that will expand the potential massively. At BankInvest Small Cap Danske Aktier, we look forward to the upcoming journey with MedTrace, during which a listing can very well become a reality within a few years”, says Stefan Ingildsen, Senior Portfolio Manager at BankInvest.

The Danish firm Vækstfonden, another shareholder in MedTrace, is also very positive at the prospect of an upcoming stock exchange listing.

The key to better cancer treatment

With the capital raised, MedTrace can mature the technology towards a clinical solution for cancer diagnostics. The goal is to differentiate hypoxic tumors – tumors with poor blood supply – from regular tumors through routine cancer screening. Patients with hypoxic tumors generally respond poorly to chemo- and radiation therapy, resulting in higher mortality. Successful treatment therefore relies on differentiating hypoxic and regular tumours early in the process.

“Our technology is already in clinical use within cardiology, and we have proof of concept that the technology also works within oncology, but we have lacked the capacity or funding to explore the area. We have that now. The investment opens new diagnostic opportunities and business areas with tracer 15O-water. We are already working on a pilot project in the USA, and that work will now accelerate rapidly and expand to other markets and more cancer types,” says Martin Stenfeldt.

For more information please contact:

Martin Stenfeldt, CEO, MedTrace: +45 28104149, martin@medtrace.dk/us

Robert Schier, Investment Director, Swisscanto Invest: +41 44 292 34 37, robert.schier@zkb.ch

Gerd Buchhave, Senior Press Officer, ATP: +45 24990911, geb@atp.dk

Stefan Ingildsen, Senior Portfolio Manager, BankInvest: sti@bankinvest.dk

– – –

About MedTrace

MedTrace Pharma was founded in 2015 by Martin Stenfeldt, Rune Wiik Kristensen and Peter Larsen. The company has developed a hardware solution which enables the production of radioactive water in clinical practice. In 2018, MedTrace merged with the software company behind a unique analytical software platform, aQuant, for radioactive water. Previously, radioactive water could not be used in practice because of an ultra-short half-life making it useless only 10 min. after production. That challenge is solved by MedTrace. With the so-called P3 device, which is placed directly next to the scanner in the hospital, it is now practically possible to produce and use the safer and more accurate radioactive water as a tracer in diagnostic scans of heart patients.

MedTrace collaborates with university hospitals in Europe, Japan and the USA including the world’s leading hospital, Mayo Clinic, headquartered in Rochester, Minnesota.

About ATP:

The ATP Group is Denmark’s largest pension and processing company. We perform tasks for almost all citizens and companies in Denmark. With pension assets of DKK 906 billion, ATP is also one of Europe’s largest pension companies. Pensions & Investments is responsible for ATP’s pension product, ATP Livslang Pension (Lifelong Pension), a collective scheme with over 5 million members. It aims to provide good, stable pensions in the form of a lifelong guarantee that we strive to safeguard in terms of real value. This is achieved through investments in e.g. bonds, shares, property and infrastructure. ATP Livslang Pension ensures that almost all citizens in Denmark have a state pension supplement on the day they retire – and for the rest of their lives.

About Swisscanto Invest by Zürcher Kantonalbank:

Swisscanto Invest is the asset management arm of the Zürcher Kantonalbank group, one of Switzerland’s largest fund providers developing high-quality investment and pension solutions for private investors, companies and institutions. The Zürcher Kantonalbank group is known for its pioneering role in sustainable investments and its investments funds regularly achieve national and international recognition. For more information please visit: www.swisscanto.com

About BankInvest:

BankInvest is a Danish asset manager and provider of value funds, investment and capital associations with total assets under management and administration of DKK 126 billion. BankInvest manages funds for approximately 210,000 private investors and a number of institutional investors in Denmark and abroad. BankInvest was established in 1969, and the owners consist of 36 Danish banks. BankInvest has approximately 110 employees.